You (or your consultant or GPO) have done all the legwork to save money on a purchased services category, and all of the new contracts are signed. Yet, somehow, the numbers aren’t lining up the way you projected. It turns out that not everyone at your organization ended up jumping on board with the agreed-upon plan. So how can you make sure that identified savings are actually being realized?

Defining Rogue Spending

In our Rogue Spending view, Valify ranks all categories where 80% of a client’s spend within each category is centralized around one or two vendors; however, the remaining 20% of that category’s spend is still going to other, smaller vendors.

Rogue spending data highlights that the health system most likely has a preferred vendor or two with contracted rates, but that not everyone has converted to using the new vendor. More conversion to the preferred vendor will realize more savings. Visibility into rogue spending is powerful in that it not only highlights the categories in which this occurs, but it also provides details into which specific hospital and which specific department has not made the conversion so that corrective measures can be taken.

Why All the Push Back?

Finding cost savings is nothing if not a time-intensive endeavor. First, the category has to be identified as a either a savings opportunity or a necessity due to a pending contract expiration. Second, the contracting department has to do research internally and externally prior to sending out a request for proposal (RFP). The following several months are spent evaluating vendors and their responses. Finally, a recommendation or selection of a new vendor (or a new contract for an existing vendor) is made based on financial and non-financial criteria. This process can take six months to over a year to complete!

Since all of these decisions are made from a very practical place, it seems like it makes sense that everyone would naturally proceed with the agreed-upon new plan. Despite the initial agreement to exactly that, though, push back often occurs at the implementation stage.

There can be multiple reasons your organization may be experiencing push back during a vendor implementation, including:

- Not-for-profit hospitals aren’t typically run using a business mindset with a top-down driven compliance requirement, even though there are many aspects of a hospital that need to be managed from a business perspective.

- Lack of information sharing among necessary parties: If you didn’t start by using a value analysis contracting approach, then can be challenging to get buy-in after the fact.

- Lack of data leading up to the RFP: You pulled the information from your financial software but didn’t realize there were missing vendors or more spend that should have been included in your analysis.

Another all-too-common issue is that sideways deals may be cut based on the projected savings with an existing, preferred vendor. Instead of committing to the new vendor that offers significant cost savings, the current vendor is approached with a, “Can you meet this price?” proposition to match the lower quote, and many vendors agree.

In theory, this might seem like a reasonable workaround that still results in cost savings. In reality, these back-alley handshake-based bargains are made without the same contract details, the same continued low-cost assurances, or the same exhaustive research and planning as the original recommendation to use the new vendor.

These types of arrangements typically happen when a hospital has brought in their GPO or a consultant to manage the process and negotiations. In these situations, the end-user doesn’t feel obligated to use the agreed upon vendor because it didn’t wasting their team’s time and energy determining that vendor in the first place. This is a slippery slope because it can damage the relationship and people will be skeptical of working with you in the future.

Working with a third-party like Valify can mean the best of both worlds, because cost savings are automatically calculated in addition to giving users the opportunity to flag preferred vendors.

A Necessary Evolution

All of this really comes down to one problem: most hospitals don’t want to switch purchased services vendors if they have not had a major issue with them recently. In one of our own real-life experiences with this scenario, only 50-60 percent of hospitals followed through with converting to the new vendor even though, on paper, they agreed to move forward if they were going to realize savings.

As you can see, even with compelling arguments and inarguable savings numbers for making the switch, inertia with status-quo vendors prevents forward motion with new vendors. This means hospitals remain unable to move to new contracts at better rates. Additionally, the vendor community loses faith in the RFP process because they feel they are getting price checked just so you can renegotiate with your current vendor.

While a certain degree of fear of the unknown is to be expected, change must occur in order to improve operation costs. When framed in terms of: “Your hospital will risk closing in X years if you don’t switch vendors which will result in significant savings,” hospitals must ask themselves: Is loyalty to my existing vendor relationships worth that risk?

The Solution

The best way to control rogue spending is to use the value analysis process when you conduct all RFPs. Next, you need to utilize a tool that tracks the implementation and standardization of your preferred vendor(s) across ALL of your locations. This will quickly show you if you are moving away from the non-contracted (rogue) vendors and increasing utilization of the newly contracted vendor(s).

Here’s how Valify identifies contracted/preferred vendors in order to identify and eliminate rogue spending:

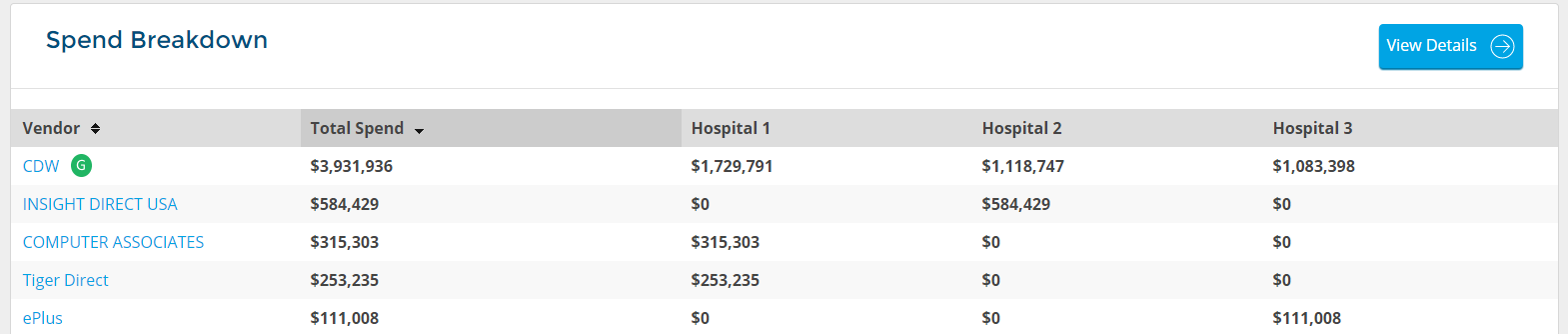

Here you can easily see which vendor is the preferred vendor and what the utilization is across all of the three hospitals within the health system. You can also easily identify the off-contract purchases so you can shoot over an email to your IT Director and remind them about your new CDW contract, for example.

It will also quantify the actual realized savings you are receiving to see if the estimated savings in the RFP (which was one of the reasons why you selected the vendor) are actually coming through to your bottom line as expected.

Below is a screenshot of how Valifys savings tracking tool calculates and displays this type of information for you. These are the same data points that you would want to track in Excel if you were doing this on your own.

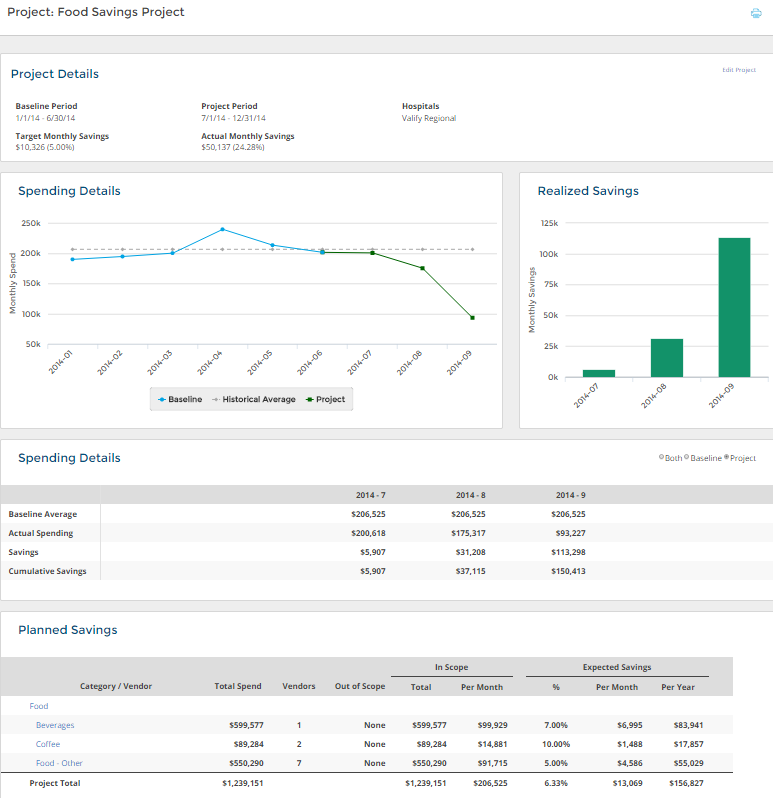

The information below is a hypothetical savings project we built around food products (not food distribution):

In the above example, the new food (and beverages) contracts started on July 1, 2014. The tool then compared the new spend to the previous six months with the blue line in the graph being the actual monthly spend and the grey dotted line being the six month average spend. The green line is the actual spend after the contracts launched.

The Realized Savings graph calculates how much you are saving (or not) for a specific time period after the launch (in this case, three months). The Spending Details section below the graphs displays the specific monthly data points. If you were paying a contingency fee to a consultant for example, you could use the Cumulative Savings number ($150,413) to calculate your payment based on REALIZED savings and not just expected savings.

The Planned Savings section has all of the specific details that were added to this project. You can add/remove subcategories and remove vendors from the scope of the project if needed. You can also input expected savings at the individual subcategory level if it makes sense.

This is a powerful tool that is helping hospitals actually calculate implemented savings in purchased services for the first time.

Conclusion

Whether you are using Excel or the Valify technology, it is imperative that you have a process in place to make sure your preferred vendors are being utilized and standardized across your entire organization.

These are easy savings to be had. Why start a new project if you haven’t standardized or implemented the previous ones?